Nike reported an awesome quarter Tuesday evening. The stock is […]

Nike Outperforming as Consumers Hit the Gym

Nike shares are trading ~21% lower YTD as the market anticipates continued supply chain woes, inflation pressure, and uncertainty related to the conflict in Ukraine and Russia.

But is the Nike consumer feeling the pressure?

According to LikeFolio data, not yet...at least not among English-speakers.

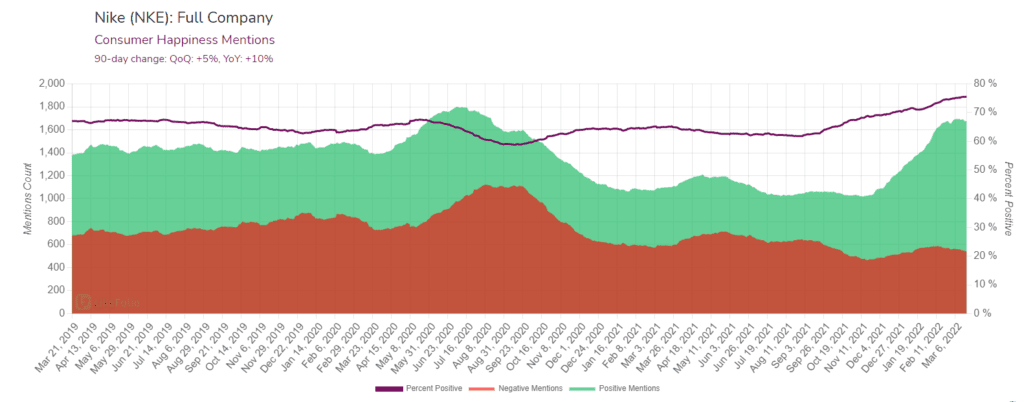

Not only are mentions rising, but Nike sentiment is exploding: +10% higher YoY.

This positive uptick in sentiment is related to specific products. Consumers love Nike's variety of colors, customizations, and collaborations. Just take a look at the company's collab with Supreme.

And consumers seem to have normalized cutting out the middle man with their purchases...

Even though Direct-to-Consumer levels have normalized vs. pandemic growth, Nike's DTC levels remain +47% higher than March 2020.

This indicates stickiness and a permanent behavior change within consumers' minds.

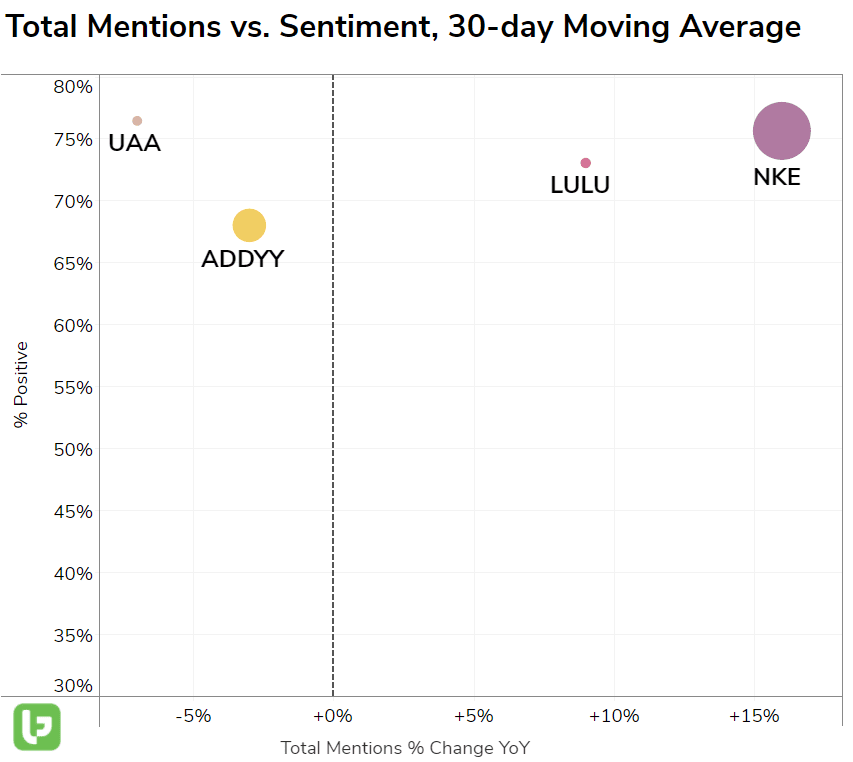

With that being said, how is this company stacking up against its competitors?

Well, it's safe to say Nike is outperforming the other leaders in this space.

We'll be watching to see how Nike sales fare in Asia amid extended lockdowns when the company reports March 21 after the bell, but long-term the American consumers look healthy.