Snapchat's IPO timing was...well... incredible. They literally took the company […]

Snapchat Shares are Catching up to its Popularity

After a significant run higher from around the $5.20 mark at the start of 2019, Snap Inc’s shares are now on the slide.

While the title may suggest that Snapchat is popular, quite the opposite seems true, according to LikeFolio data.

Snapchat's current decline is in line with its online popularity, and there is a case to say it could see a further move lower.

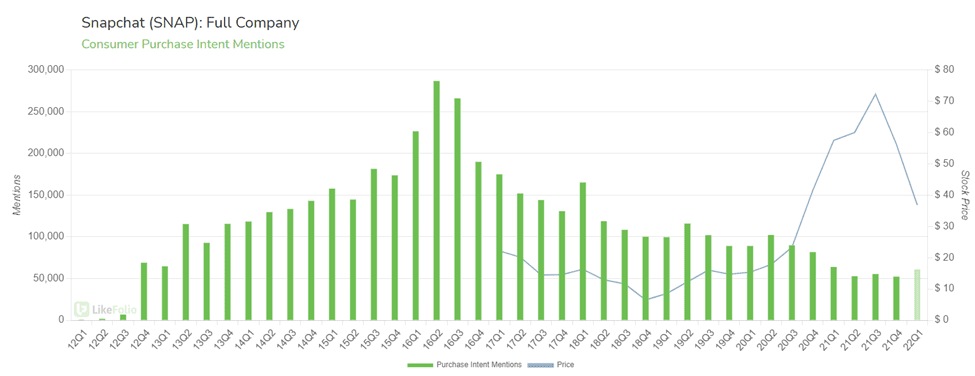

Take a look at the chart below...

You can see that despite a slight rise this quarter, Snap's purchase intent mentions (people talking about signing up to Snapchat) have consistently fallen since 2016. Despite a 7% QoQ rise, it is down 29% from last year.

And, with the recent share price plunge, it looks as though Snap's share price is finally falling in line with its social media popularity.

Furthermore, even online mentions of happiness and unhappiness about Snapchat are falling. So, in other words, people tweeting about how much they love or hate the app, are on the decline, while its overall happiness score has ever so steadily fallen. Now, as you have probably already seen, Snap shares have begun to push higher after the recent fall, albeit not significantly. They started to rally after the company reported earnings which showed a 42% YoY revenue growth, with revenue forecasts smashing analyst expectations.

That's all well and good, but to maintain that growth and realize its revenue forecast, Snapchat needs users...

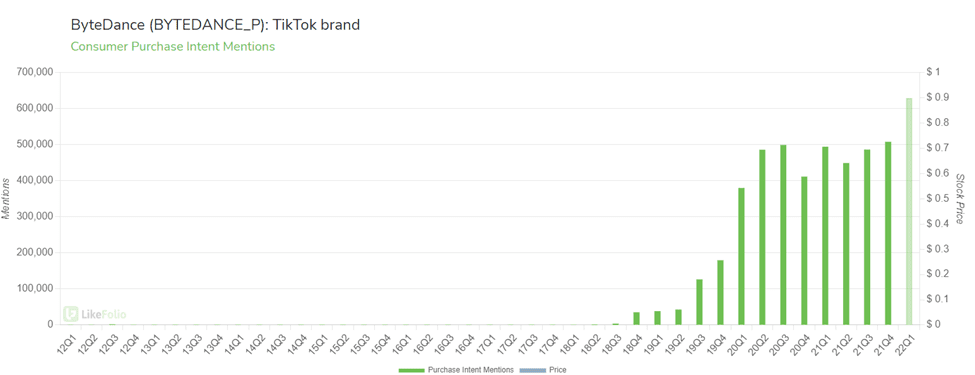

But, those users prefer TikTok...

Bottom Line: Yes, Snapchat reported positive earnings in Q4, with encouraging revenue results, but according to our data, investors should be concerned that a company that needs online engagement to attract users to its platform, has seen a consistent decline over the last few years. Snapchat needs to find a way to entice the younger generation back to its app.