Retail EPS: Walmart (WMT), Target (TGT) Consumer behavior shifts during […]

Sneak Peek: Early Holiday Shopping Leaders are Emerging

Eyes are already on retailers ahead of this Holiday shopping season as the market anticipates which retailers have fallen into and out of favor with consumers.

At LikeFolio, we've got our eyes on 2 key indicators to understand which companies stand to gain...or lose:

First: Understand the major macro-level consumer behavior shifts in the last quarter.

When it comes to holiday shopping, three trends caught our eye:

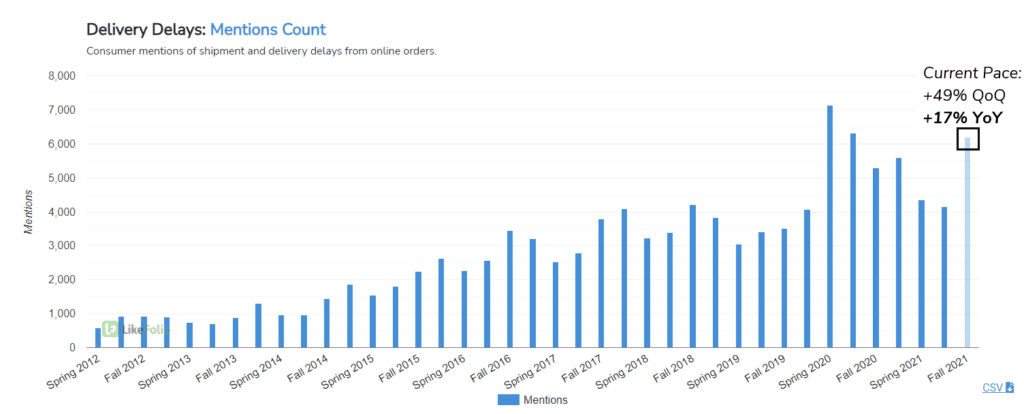

Consumer Mentions of experiencing Delivery Delays: +49% QoQ

Consumers are very aware of potential timing issues with online orders and anything coming in from overseas, and they're adjusting accordingly. Many are placing orders early to ensure proper delivery. This is in line with a theme that emerged in 2020 when consumers began Holiday shopping well before traditional Black Friday sales. In addition, same-day fulfillment offerings including delivery or buy-online-pickup-in-store are likely to resonate with consumers.

- Mobile Shopping Mentions: +26% QoQ

We touched on this earlier this week when we previewed Walmart earnings. Companies with robust mobile shopping experiences are positioned to thrive this Holiday season. - Mall Shopping Visits: -17% QoQ

Data isn't recording a huge resurgence in the total number of visits consumers are making to malls, specifically. However, trends reported by retailers like Home Depot and Target (and also reflected in external research) indicate when consumers are shopping, they're spending more. I.e. lower traffic, higher average ticket...and this ultimately IS driving sales higher on a YoY basis.

Second: Understand how retailers are performing vs. peers.

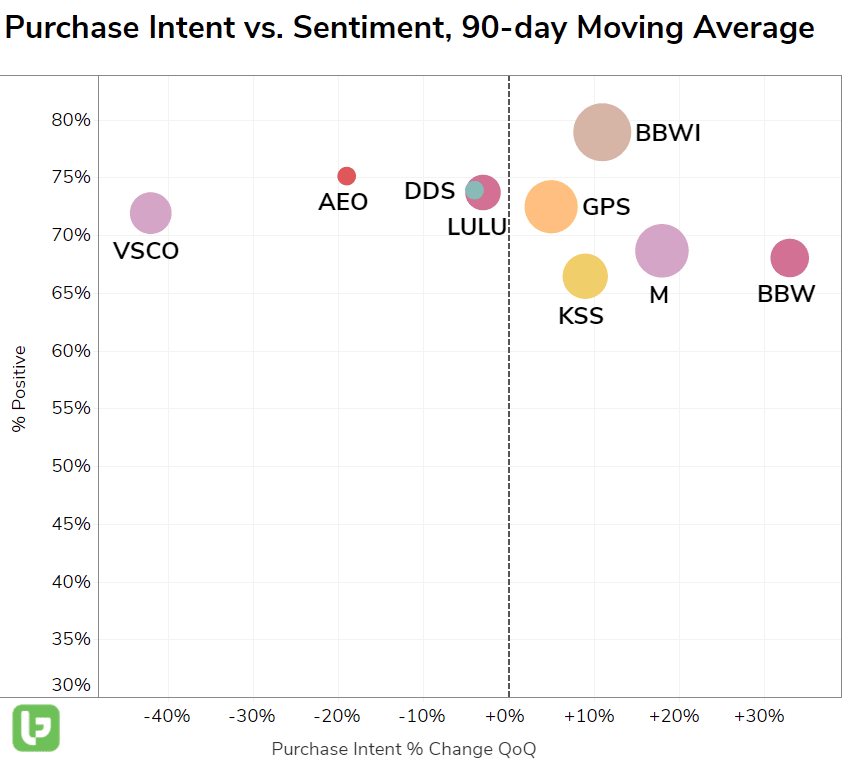

We use an outlier grid to plot company demand growth vs. consumer happiness levels. This gives us an idea of which retailers are gaining near-term momentum when it comes to purchasing behavior and overall experience.

The chart above illustrates how major "mall" retailers are faring, comparatively. Note momentum from Build-A-Bear (BBW) and Macy's (M) specifically, on the far right of the chart. Meanwhile, Bath & Body Works (BBWI), American Eagle Outfitters (AEO), and Lululemon (LULU) are sustaining the highest levels of Consumer Happiness. In contrast, Victoria's Secret (VSCO) is falling behind all peers in demand growth and most peers in happiness. Keep an eye on retailer positioning in the next few weeks as consumers continue to shop for the Holiday season. For now, some surprising leaders are emerging.