Despite recent market volatility and some arguing for a bear […]

Social Activities are Back in Full Force

The pandemic and great reopening had a significant impact, both good and bad (*cough Peloton) on various industries.

But as time wears on, those impacts lessen.

For example, new gym memberships, which rallied at the start of the year — also helped by new year resolutions — are flattening.

But some trends haven’t abated, and are getting get stronger as we head into the summer.

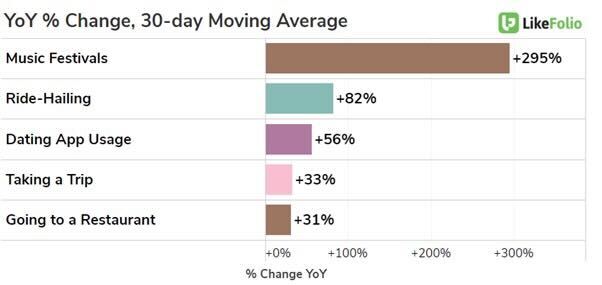

Social events are booming.

2022 has even been described as the ‘Year of the Wedding’.

It's understandable, considering restrictions that have loomed over the past two years.

The important takeaway for traders and investors? Strength in these key consumer trends is also helping to drive demand in specific industries…

Here are the industries and companies we’ve got our eyes on that can be expected to benefit in the near term:

1. Ride-Hailing

For example, consumers out and about are increasingly utilizing ride-hailing services…especially as gas price concerns loom.

Mentions of calling an Uber, Lyft, or corresponding service are trending +82% higher YoY. Mentions of taking a cab are also pacing higher, +52% YoY.

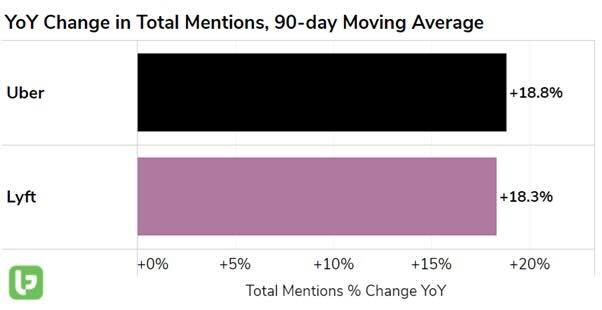

This demand appears to be boosting mentions of Uber and Lyft equally:

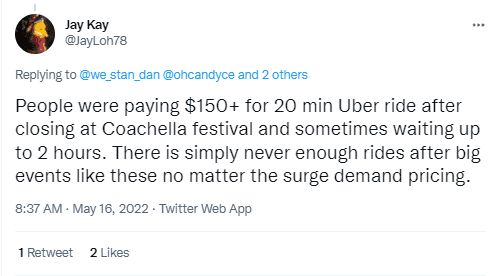

However, both companies are battling rising gas prices, driver shortages, and demand surges.

Demand during festival season for vacation rentals, hotels, and rideshares spiked recently, causing a surge in prices across the board.

This hasn’t translated to a significant impact on happiness levels…yet.

But it does appear that Lyft may be navigating short-term obstacles a bit better. Happiness levels have risen at a steeper clip in the last quarter.

Long-term, keep an eye on Uber’s Super Travel App goals. The company announced a partnership this week that will expand its services to private buses and coaches, targeting special events like weddings.

From a momentum perspective, LikeFolio’s data is more positive for UBER down the road.

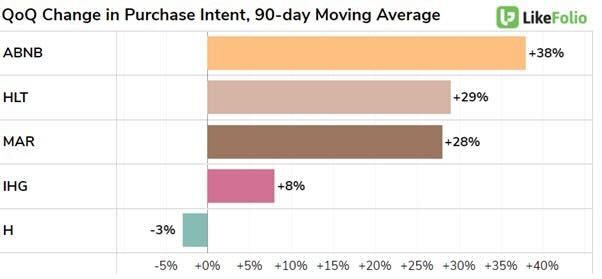

2. Travel

In the travel sector, Airbnb continues to outperform traditional peers.

ABNB shares plummeted in early May, despite a strong 22Q1 report that beat expectations.

However, underlying demand remains strong. Airbnb Purchase Intent Mentions are rallying in Q2 as well, pacing +17% QoQ and +37% YoY.

3. Fashion

Socialization also calls for new outfits --

Even if it means paying high prices due to soaring inflation.

Purchase Intent mentions for Revolve, which markets itself as a next-generation fashion retailer for Millennial and Generation Z consumers, continues to soar, rising +71% QoQ and +68% YoY.

Another highflyer is event-centered, high fashion rental company Rent the Runway.

RENT shares have plummeted since the company’s IPO in October of last year. But LikeFolio data suggests it may be receiving renewed consumer interest.

Keep an eye on this name for potential divergence opportunities.

Bottom Line: Despite some trends and/or industries losing steam alongside reopening activity, others are thriving.

Understanding these ripple effects and isolating potential winners is the LikeFolio edge.