Projecting company seasonality midway through the busy season can give […]

Trend is your friend $GOOS

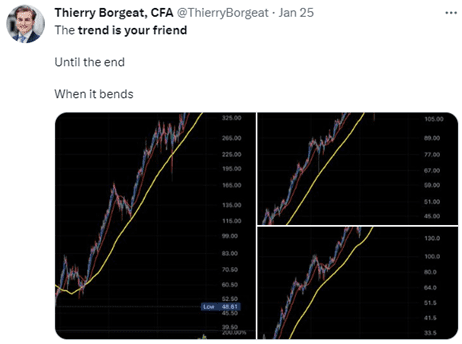

The trend is your friend!

How many times have you been told this by a seasoned trader, or even a newbie picking up new tricks?

The age-old saying is built on the premise that generally speaking, market trends can be fairly easily identified and are likely to continue in their current direction (thus bolstering trading profit profitability)…until they don’t...err until they bend.

In this broad example, the “trend friend” is applicable to market or single equity performance.

At LikeFolio we can apply the same thought process on the consumer side of things: macro trends – or shifts in consumer behavior and preference – are likely to serve as major headwinds or tailwinds for the companies operating in related segments.

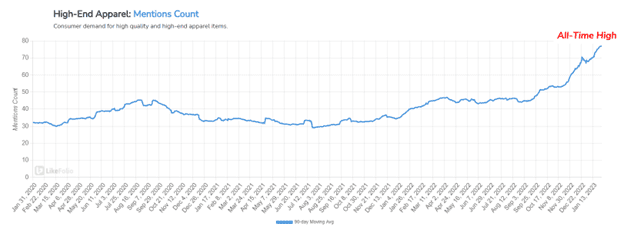

In the case of Canada Goose, famous for its luxury puffer jackets with thousand-dollar price tags, the trend is consumer demand for high-end apparel.

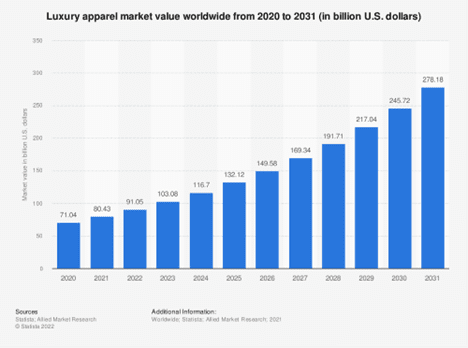

Consumer proclivity for high-quality (and high-dollar) retail is at all-time highs, even amid an inflationary environment. The global luxury apparel market is expected to exceed $278 billion by 2031, a 291% increase vs. 2020.

Luxury apparel demand has served as gas in the tank for Canada Goose demand AND the company's share price.

Luckily, LikeFolio data saw this coming.

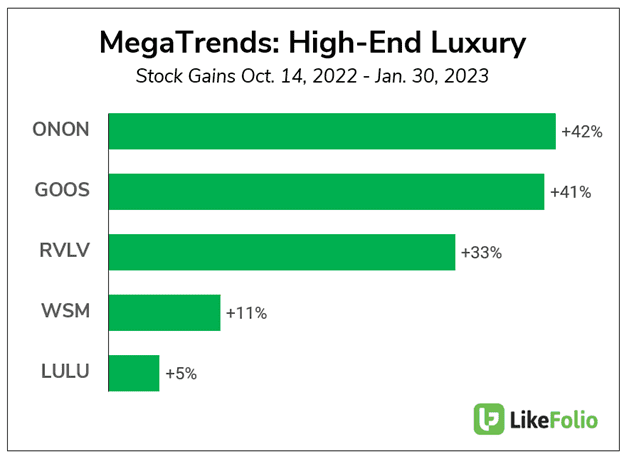

We featured GOOS as a major winner in the October MegaTrends Report: High End Retail.

Since the report send, GOOS shares have gained more than +41% in value!

In fact, every company featured in that report is sitting comfortably in the green, with an average gain of +26%…in just over 3 months. (For reference, the S&P has gained about +13% in the same time frame).

Here's the next important question: is the trend still our friend, or is it starting to bend?

High end apparel demand remains strong, adding one point to the bullish camp.

GOOS digital data confirms growth in the last quarter but its momentum is slowing a bit, making a case for the neutral zone.

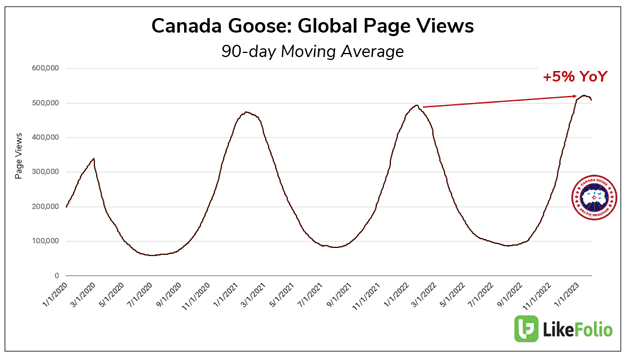

Global page views for Canada Goose's direct-to-consumer retail site were +5% higher YoY on a 90-day Moving Average.

But this growth rate slowed significantly in the last month.

If we check a 30-day moving average, the page views actually slipped by -12% YoY.

This tells us that consumer spend was front-loaded in the quarter to be reported.

Thus, guidance may be a bit underwhelming vs. the actual quarterly results…still strong, but the only weak spot we see.

Bottom line: We're officially neutral heading into this earnings report, partially because the market is already pricing in a solid performance.

Long-term: we think this brand has legs.

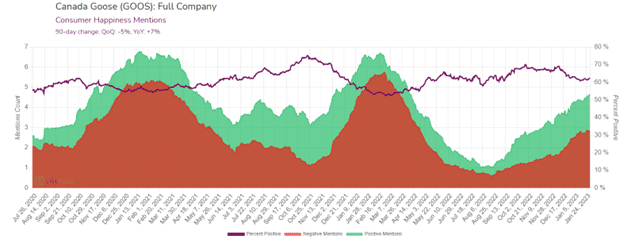

Consumer Happiness levels have risen by +7 points YoY…a strong positive indicator for future brand growth.

Consumers often tout the brand's quality, longevity, and popularity among peers…much to some consumers’ dismay.

For us (and members), GOOS is already a proven winner.