Drinker’s tastes and priorities are shifting in a major way. […]

Trend Watch: Fizz is Out, Non-Carbonated is In

| Consumer preference shifts can come at you fast, so it’s good to have a data advantage that can quantify consumer chatter in real-time. A fantastic (and current) example of this is the explosion in popularity and demand for drinks without carbonation: |

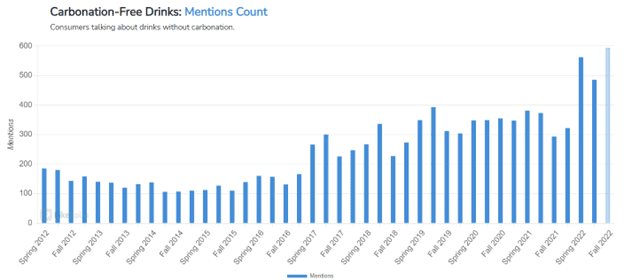

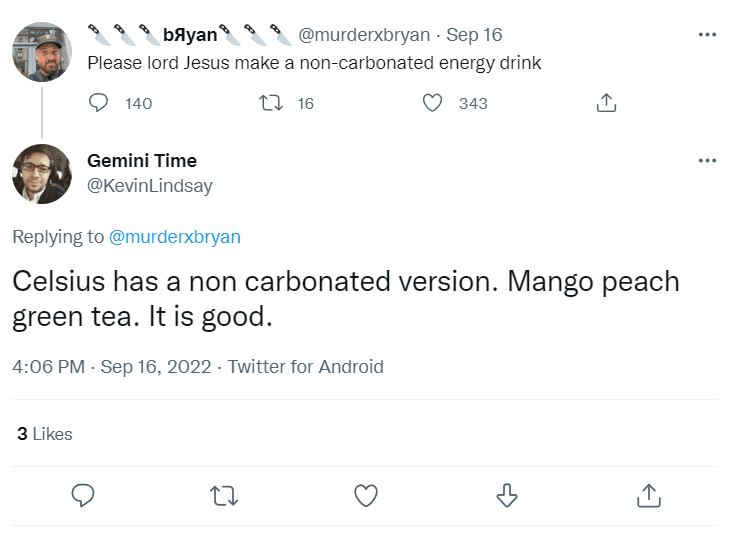

| As you can see from the LikeFolio Consumer Demand chart above, consumer mentions of non-carbonated drinks spiked in the Spring of 2022 and are currently on pace for a record quarter in Q3. The driving force? Health. Carbonated drinks may aggravate existing gut issues even more, especially in people with IBS, Crohn’s disease, or acid reflux. By skipping the fizz, many folks are finding their evenings more enjoyable… and often better tasting. Potential (Early) Winners: Boston Beer Company (SAM): As we noted earlier this year, Twisted Tea is a non-carbonated, alcoholic beverage that is reviving SAM’s consumer buzz after the hard seltzer craze began to fizzle out in early 2022. Celsius Holdings (CELH): We’re seeing some good buzz around Celsius’ new non-carbonated energy drinks. |

Monster Energy (MNST): The REHAB brand is gaining favor with consumers looking for an uptick in energy without the spicy fizz.

Private companies like NOCA/Boozy Lemonade, BeatBox, Mom Water, and Guayaki Yerba Mate are also staking a claim in the non-carbonated movement.

Potential Losers:

Pepsi’s (PEP) SodaStream has built its entire business model on delivering carbonation to your home. While once a fan favorite, we’re concerned about the prospects for this brand as consumers shift away from the fizz. Luckily, Pepsi is one of the most diversified companies in the world and should have no problem reacting accordingly.

Bottom line: Beverages (both adult and non-alcoholic) are an extremely competitive category, and the consumer can be fickle.

Brands should be aware -- Fizz is out, health and flavor are in.