Here's what LikeFolio data was showing heading into the Walmart earnings report that sent the stock 10% higher.

What is Driving Target's Edge vs. Walmart

June 7, 2021

What is Driving Target's Edge vs. Walmart

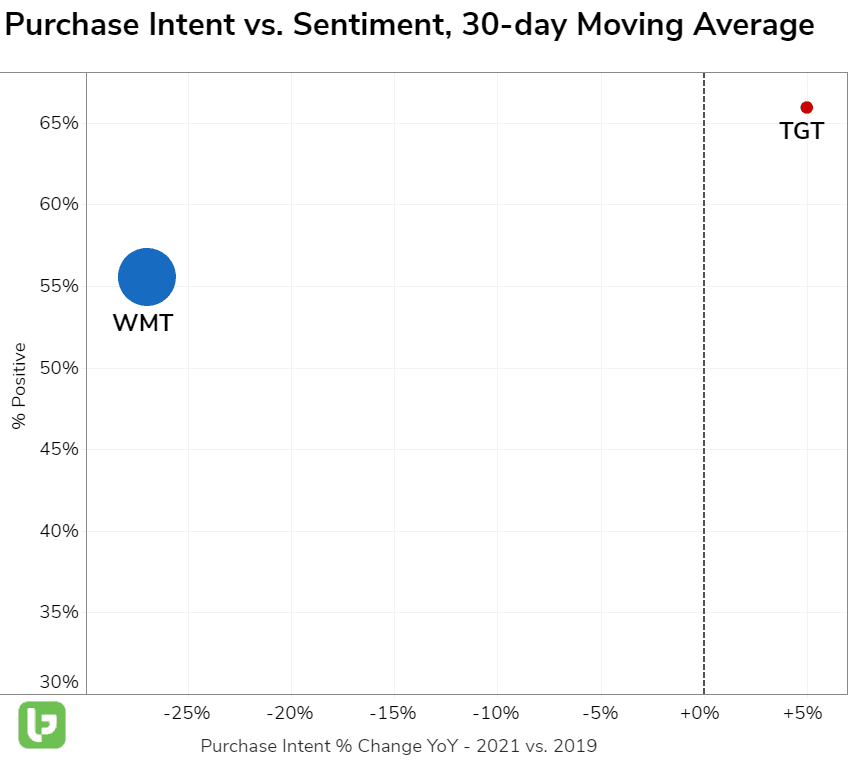

Both Target (TGT) and Walmart (WMT) exceeded earnings expectations on their last reports, but Target is showing signs of elevation vs. its larger peer. U.S. Walmart comps increased +6% while Target comps increased +22.9%. You can see this separation in momentum on the chart below:

What gives?

- Target Consumers are much Happier. Target Sentiment is +12 points higher vs. Walmart, as consumers report a better overall experience in-stores and via delivery services.

- Target has a premier Same-Day fulfillment experience. Walmart+ (Walmart's same-day delivery membership) registers Happiness levels near 61% positive. In contrast, Target's comparable Shipt service boasts Consumer Happiness 6 points higher.

- Target has a logistics advantage. Target fulfills more than 95% of digital orders via its stores. Walmart doesn't give a hard store-fulfillment figure, but did note capacity was an issue in fulfilling delivery and pickup requests, and ultimately driving Walmart+ memberships: "The number one driver of selling memberships is the grocery, Supercenter, pickup and delivery. And as we said before, capacity is our issue there."

Both Target and Walmart have benefitted from major shifts in consumer shopping behavior in the last year, and flex an omnichannel edge vs. digital-heavy Amazon.

Short-term, it's clear Target has an edge.