PepsiCo (PEP) The quarantine 15 didn't materialize out of thin […]

5 Stocks to Watch This Week ($RIVN, $PLAY, $EBAY, $BAC, $PEP)

July 11, 2022

| Earnings season has officially kicked off! Here are some key stats and data points on stocks that LikeFolio is watching this week: Rivian (RIVN) |

- RIVN shares gained as much as +20% last week after the company confirmed its annual production target of 25,000 vehicles and announced accelerated output in Q2.

- Prior to this announcement, RIVN shares sold off significantly from post-IPO highs as the company struggled to manage parts shortages and increased cost of materials, resulting in a vehicle price-increase-then-take-back after consumer outrage.

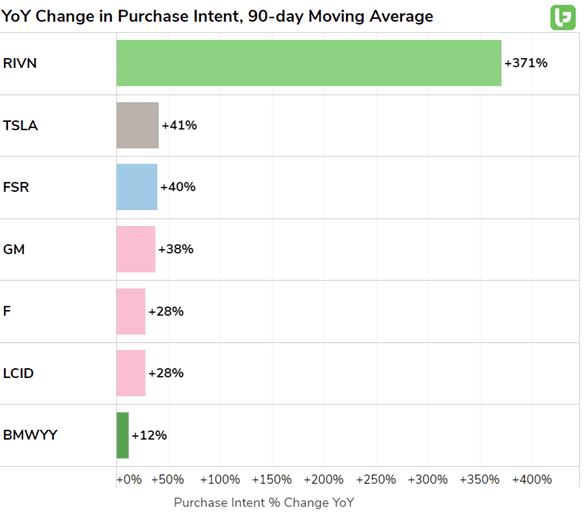

- LikeFolio identified Rivian as a consumer favorite in the electric vehicle space in the December MegaTrends report of other EV players.

- Data suggests consumer DEMAND for Rivian vehicles continues to outperform peers, with mentions rising more than +370% YoY.

- Delivery mentions remain positive, rising +11% QoQ -- in line with company reports.

- Demand for electric vehicles across the board is rising (+224% YoY) as gas prices surge.

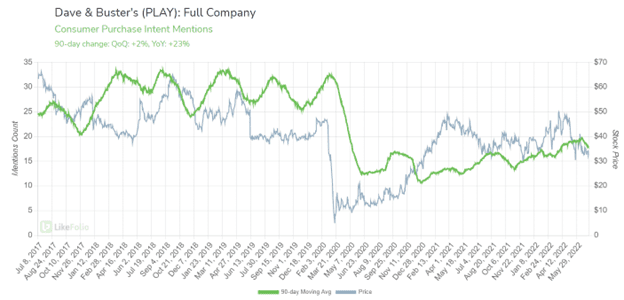

| Dave & Buster’s (PLAY) |

- Dave & Buster’s (PLAY), an entertainment venue featuring food, spirits, and games for adults is expanding its footprint.

- PLAY completed the acquisition of fellow experience venue, Main Event, at the end of June. The deal involves the installment of Chris Morris (previously CEO of Main Event) as the new CEO of Dave & Buster’s.

- Consumer mentions of visiting Main Event have a lower volume vs. Dave & Buster’s, but Main Event is experiencing slightly higher demand growth.

- Main Event Demand: +32% YoY, Dave & Buster’s Demand: +25% YoY

- Main Event operates 50 locations nationwide – fewer than Dave & Buster’s 147 locations – but does prevent a significant opportunity for future growth.

- Collectively, Dave & Buster’s demand has continued to build by double digits as social events resume in 2022.

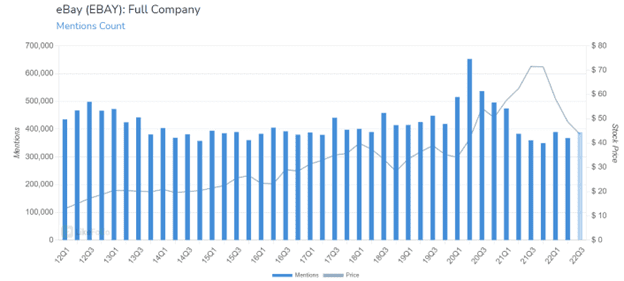

| eBay (EBAY) |

- LikeFolio data has detected an inflection point for the eCommerce staple, eBay (EBAY).

- For the first time in 6 quarters, consumer buzz for Ebay is rising on a YoY basis, currently pacing +8% higher in 22Q3.

- Another good sign: eBay Consumer Happiness has increased by +2 points in the same time frame, suggesting the buzz is positive.

- Tweets reveal growing consumer demand for unique collectables like sports cards and exclusive sneakers is driving eBay buzz and happiness higher.

- EBAY shares have fallen by more than -40% over the last 9 months as covid-darlings continue to underperform the overall market.

- We’ll be monitoring for continued improvement and members will be alerted to any actionable opportunities.

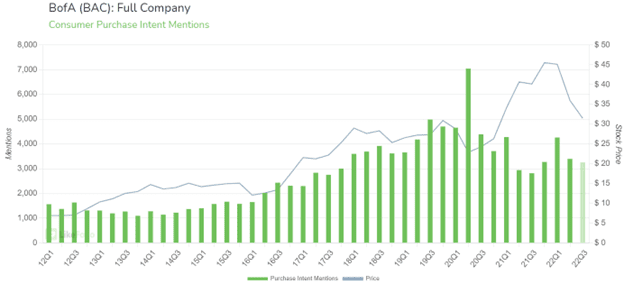

| Bank of America (BAC) |

- Bank of America (BAC) is set to report earnings results for the quarter ended 6/30 next Monday morning (7/18 before market). LikeFolio data suggests an optimistic outlook.

- In the reporting quarter, BAC Purchase Intent Mentions gained +15% YoY and fell -4% QoQ, a marked improvement on to the -58% YoY, -31% QoQ decline seen in the prior year.

- Bank of America is showing year-over-year growth across all 3 of its key metrics.

- BAC shares have underperformed in recent months, down -31% YTD — The Financial Select Sector SPDR Fund (XLF), a popular financial sector ETF, has only pulled back nearly -20% YTD.

- Despite the recent weakness, Bank of America has a history of positive EPS surprises, beating estimates on its past 8 reports.

- If you want to place an earnings trade, keep in mind that this Friday will be the last day to place a trade before the report!

| PepsiCo (PEP) |

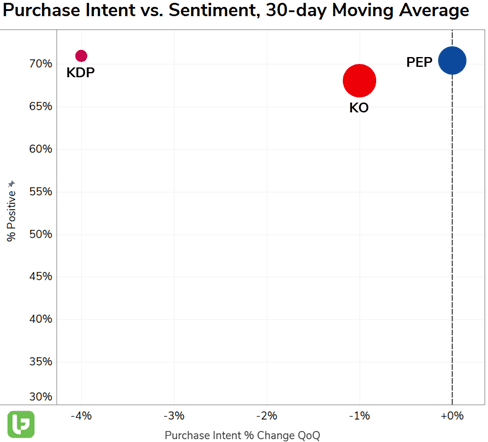

- PepsiCo (PEP) is showing unique outperformance in terms of QoQ PI growth (QoQ), showing less decline than that of its rivals Coca-Cola (KO) and Keurig Dr. Pepper (KDP).

- Overall, the entire beverage industry has shown strong year-over-year growth in both consumer demand and revenue in 2022. PEP has not been an exception, reporting sales up +9% YoY last quarter.

- PepsiCo is scheduled to release earnings for the quarter ended June 11th (22Q2) today after the close. We’re expecting to see another strong report from this multi-national conglomerate.

- Going forward, we’re maintaining a bullish bias on the beverage industry at large, specifically the largest players: PEP and KO.

Want FULL Access? Click Here for LikeFolio Pro

Tags:

$EBAY, $PEP, BAC, Bank of America, Dave & Buster’s, PepsiCo, PLAY, Rivian, RIVN