“You know it's time to sell when shoeshine boys give […]

Can Rising Crypto Prices Cancel Out Regulatory FUD? ($COIN)

Can Rising Crypto Prices Cancel Out Regulatory FUD? ($COIN)

Yesterday, the Bitcoin ($BTC) completed a month-long correction and bounce, coming full circle with a return above the troublesome $50K price level.

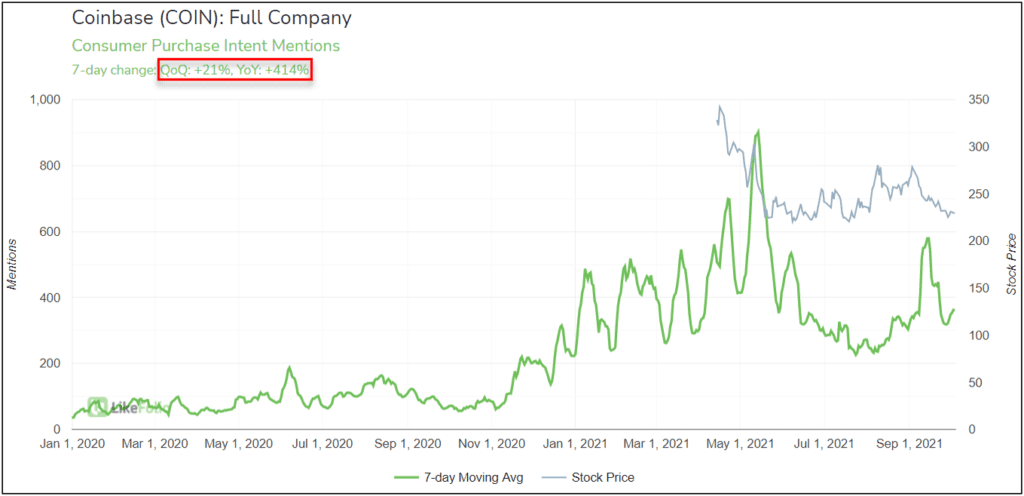

As the largest US-based supplier of BTC (and other blockchain assets), Coinbase ($COIN) has experienced a healthy resurgence of underlying consumer Demand growth – COIN shares have also rallied from the Monday lows...Will both uptrends be able to hold? COIN Purchase Intent Mentions, consumer mentions of signing up for a Coinbase account and using the platform to buy/sell/trade cryptocurrencies, are trending +21% QoQ and +414% YoY on a 7-day moving average.

The 7-day PI trend-line briefly popped higher in September, due to a controversial ruling from the SEC regarding COIN’s proposed “Coinbase Lend” service – Mention volume has since pulled back but maintains an upward trajectory.