Happy Thanksgiving! Here are some names and markets that the […]

Dick’s Sporting Goods Could Beat Earnings Expectations, Here’s Why…

Dicks Sporting Goods is set to report earnings Tuesday before the open…

In the third quarter, the Coraopolis, Pennsylvania-based company reported earnings and beat revenue, and, according to LikeFolio data, Q4 could do just the same.

Here are two reasons why…

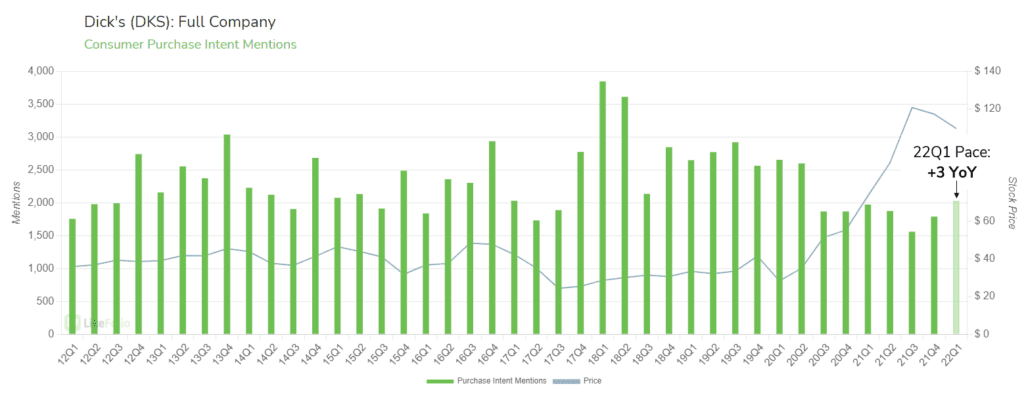

1. Purchase Intent - It all starts with Consumer Demand.

As you can see, Purchase Intent Mentions crept higher in the fourth quarter, up +16% from Q3 2021, and that climb has continued into the first quarter of this year.

However, something more interesting looking back to previous quarters…

The blue line in the chart above represents DKS revenue. What you can see is in the previous Q4s, the company usually experiences a spike in Consumer Demand and, as a result, a rise in revenue.

That trend started to die down just before the pandemic, which obviously further impacted it.

But, Purchase Intent Mentions in Q4 2021 have risen from Q3.

So the question is, will that trend re-emerge?

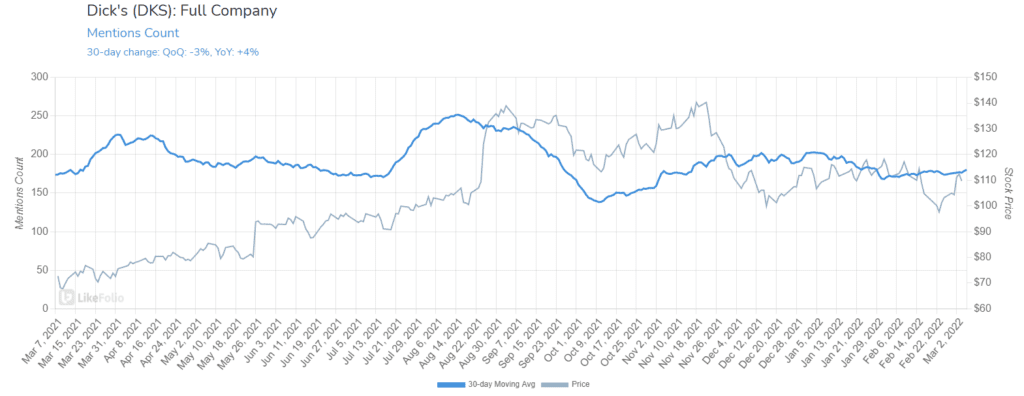

2. Consumer Buzz - Consumer Mentions of Dick's Sporting Goods continues to rise in the current quarter.

Consumer Mentions experienced a steady fall from around Q3 2019 until Q3 2020.

However, mentions have picked up some steady momentum since then, with Q4 +6% above Q3 2021 and +22% above Q3 2020.