Black Friday Weekend (leading into Cyber Monday) can make or […]

Is It Time for a Target Comeback?

From setbacks to potential comebacks, Target (TGT) has been on a rollercoaster ride in the fiercely competitive retail market.

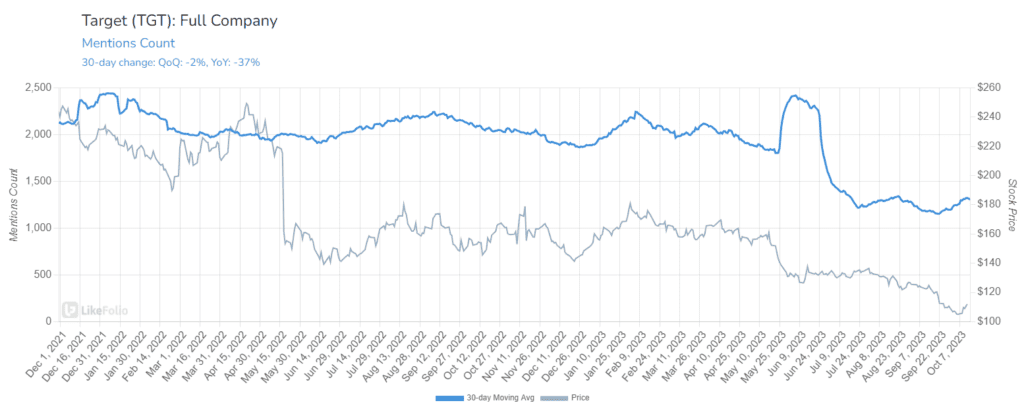

With its stock receding nearly 40% from February's highs, industry onlookers and investors alike are pondering: is it time for a TGT resurgence?

While the company's Pride collection stirred societal debates earlier this year, deeper issues trace back to a significant surge in "inventory shrink," an industry term for theft and loss.

Target, leading the conversation, flagged this growing concern in May when it noted a $500 million impact on its business. Its second-quarter financials continued to shoulder the impact of this alarming consumer trend, showing shrink costs that soared $219.5 million above last year's metrics, a trajectory that suggests the company might witness over $1 billion in losses by the end of this fiscal year. This daunting reality has compelled the closure of nine stores particularly plagued by theft.

Nevertheless, Target isn't navigating these challenges in isolation. Retail behemoths, including Lowe's, Macy's, TJX Companies, Ulta, Dick's Sporting Goods, and Dollar Tree, are all in the same boat, battling shrink while also grappling with other margin-eroding factors such as aggressive discount strategies, inventory overhangs, and persistent supply chain disruptions.

Amidst this backdrop, Target's second-quarter results painted a picture of resilience with profits surpassing expectations, though sales fell short, prompting a downward revision of its annual forecast. Surprisingly, this mixed report card was followed by a 3% climb in stock value, potentially signaling investor confidence in the retailer's strategic pivot and durability in the face of macroeconomic headwinds.

But this prompts the question — is Target on the brink of a comeback?

Insights from LikeFolio indicate a cautious yes, but with reservations. Though brand mentions are down 37% year-over-year, pointing to decreased consumer engagement, there's an uptrend in customer satisfaction.

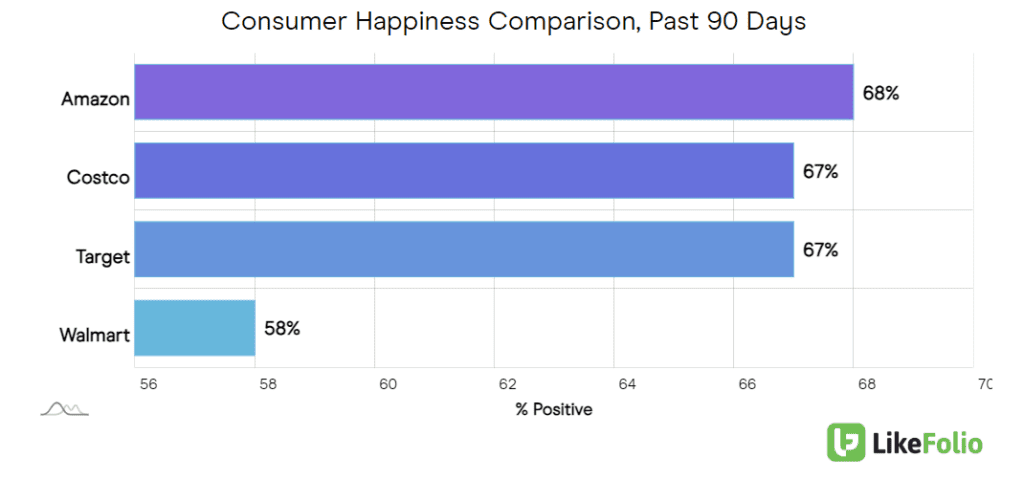

Post-Pride month controversy, Target has rebounded in consumer happiness metrics, re-establishing itself as a front-runner in the retail space.

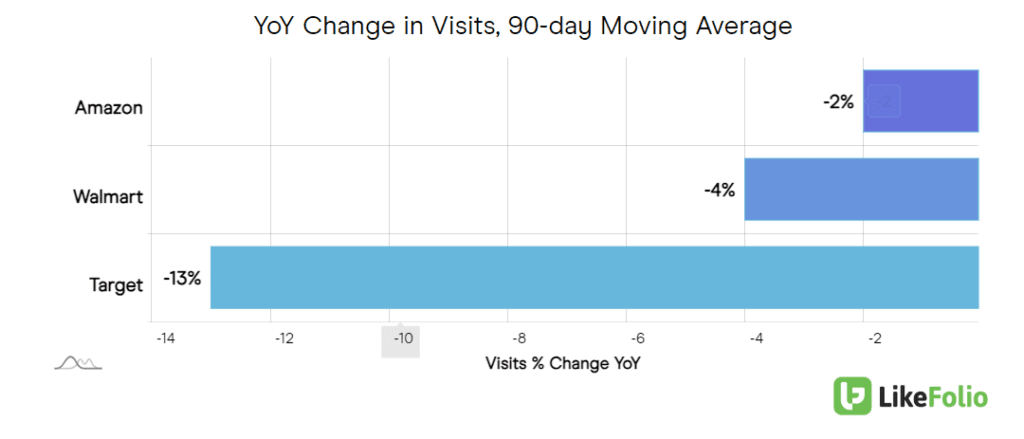

While online performance metrics don't particularly stand out, Target's ace in the hole remains its superior in-store customer experience.

Bottom Line:

The expectations for TGT may be subdued at the moment, but these low expectations could set the stage for a notable comeback. The resurgence in customer satisfaction post-controversy is promising. However, we're keeping an eye out for enhancements in eCommerce dynamics and a revitalization in brand mentions before heralding a bullish stance. For now, cautious optimism is the name of the game for investors and analysts alike.